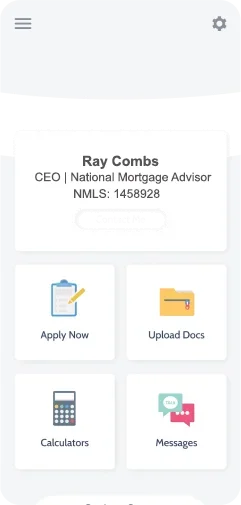

The Loanzify App guides you through your mortgage financing and connects you directly to your loan officer and realtor.

Welcome to Mach Mortgage, a next generation National Mortgage Lender built for speed, precision, and lasting impact. Inspired by the legendary SR71 Blackbird, we operate with the same mission driven intensity, moving fast, thinking ahead, and delivering results that exceed expectations.

We are more than a mortgage company. We are a strategic partner in your homeownership journey. Whether you are a first time homebuyer, a seasoned investor, self employed, or looking to refinance, Mach Mortgage delivers tailored loan solutions to fit your unique goals. We understand that every client’s story is different, which is why we go beyond the numbers to craft financing strategies that truly work for you.

Licensed in multiple states and rapidly expanding across the country, our team blends deep local expertise with national resources. From conventional loans and jumbo financing to FHA, VA, construction, and specialized programs, we provide a full spectrum of lending options backed by cutting edge technology and unmatched personal service.

At Mach Mortgage, we believe mortgage lending should be fast, transparent, and empowering. Our advanced lending technology streamlines the process while our experienced team provides human insight and guidance at every step. This combination ensures that you not only secure the right loan but do so with confidence, clarity, and speed.

We help residents find the keys to their dream homes, empower investors to expand their portfolios, and support developers in building the communities of tomorrow. Whether you are financing a primary residence, a second home, or an investment property, we have the products, programs, and expertise to help you move forward.

At Mach Mortgage, we do not just process loans. We build relationships, fuel dreams, and accelerate your path to ownership and investment success.

Ready to take off? Your journey starts here.